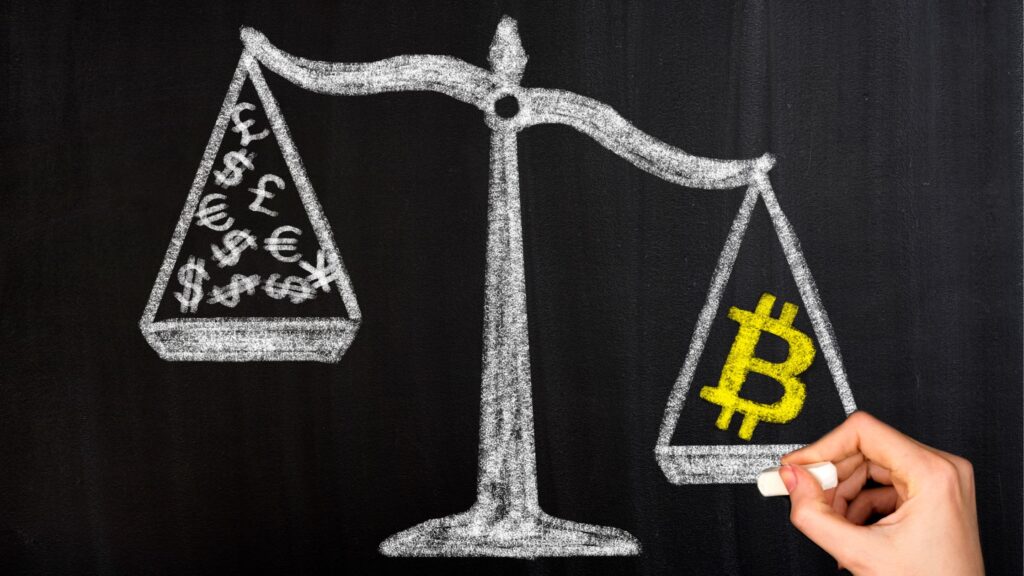

Bitcoin’s market dominance has soared to its highest level in 3.5 years, nearing 60%, as altcoins struggle to gain momentum. This rise in Bitcoin’s market share underscores its status as the go-to asset for investors amid a subdued altcoin market, with altcoins either trading flat or losing value over the past 24 hours.

On October 15, Bitcoin’s dominance surged to 58.77%, the highest since April 2021, according to data from TradingView. At the same time, Bitcoin’s price hit a 10-week high of $67,800 before experiencing a sharp dip to $64,880, only to recover and trade just above $67,000. Its market capitalization also reached a staggering $1.32 trillion, further cementing its dominant position in the crypto space.

Historically, when Bitcoin’s dominance increases, altcoins often suffer, and this scenario appears to be playing out again. While Bitcoin gained 2.5% on the day, altcoins either stagnated or saw declines. However, some traders believe this Bitcoin dominance surge is temporary. This could lead to a resurgence of altcoins in the coming weeks.

Bitcoin Hits 10-Week High, Cementing Its Dominance

On October 16, crypto expert Benjamin Cowen predicted that Bitcoin’s dominance could peak around 60%, signaling that a reversal could be near. Investor Coach K Crypto, who has over 129,000 followers on X, echoed this sentiment, suggesting Bitcoin’s dominance may have already reached its peak for this cycle. According to him, once Bitcoin “rips” higher, the door could open for altcoins to take the spotlight. He also hinted at a breakdown in Bitcoin’s dominance, which could fuel the rise of memecoins and other major altcoins.

Another prominent analyst, Moataz Elsayed, weighed in on October 14, forecasting that Bitcoin’s dominance is on the verge of a significant drop, potentially sparking the long-awaited “altcoin season.” This is particularly noteworthy for Ethereum (ETH). Which is traditionally one of the first altcoins to rally when Bitcoin’s dominance declines. However, the ETH/BTC ratio has dipped to its lowest level since April 2021. Now sitting below 0.039, according to TradingView, indicating that Ethereum is struggling to gain ground against Bitcoin.

The underperformance of altcoins can be attributed to several factors, including regulatory scrutiny and concerns over their long-term utility compared to Bitcoin. Projects like Solana, Cardano, and Polkadot have faced challenges in maintaining their previous momentum. While Bitcoin continues to attract attention from both retail and institutional investors.

Institutional Inflows and Bitcoin ETF Impact

Institutional interest in Bitcoin remains strong, as evidenced by substantial inflows into U.S. spot exchange-traded funds (ETFs). On October 15 alone, these ETFs saw net inflows of $371 million. According to Farside Investors, This contributes to a three-day total of over $1.1 billion. This growing institutional demand is a key driver of Bitcoin’s dominance and price surge.

Moreover, market anticipation is building around the possible approval of a Bitcoin spot ETF by the U.S. Securities and Exchange Commission (SEC). If approved, this ETF could unlock a flood of institutional capital, driving Bitcoin’s price even higher and potentially pushing its market dominance beyond 60%. The approval of such an ETF would mark a significant milestone in Bitcoin’s maturation as a mainstream investment asset.

Psychological Price Level and Bitcoin’s Next Move

Bitcoin is also approaching a critical psychological price level of $69,000, which it last reached during its 2021 bull run. Analysts believe that breaking through this level could trigger a new wave of buying pressure. Potentially pushing Bitcoin toward its all-time high of $73,738, set in March of this year.

Despite Bitcoin’s steady rise, some traders remain cautious, noting that a prolonged dominance surge could signal market fatigue. Once Bitcoin stabilizes or retraces, altcoins could see a resurgence, with many expecting a robust altcoin rally in the months ahead.

What Could Trigger an Altcoin Rally?

Several factors could contribute to an altcoin rally. First, the development of decentralized finance (DeFi) platforms continues to expand, with projects like Aave and Uniswap offering innovative financial services on the blockchain. Second, the growing popularity of non-fungible tokens (NFTs) could also drive attention back to Ethereum and other altcoins that support NFT ecosystems. Finally, new advancements in blockchain scalability, security, and interoperability could give altcoins the boost they need to capture market share from Bitcoin.